Trading on WhiteBIT for Newbies

Trading cryptocurrency is easy, see for yourself! We have prepared a short guide on how to use our exchange. In this article, we will walk you through all the stages of trading and exchanging assets, introduce you to the basic concepts, explain what an order is, how to create one, and what types of orders are available on our cryptocurrency exchange.

Read our instructions and try your hand at trading right away!

How to buy or sell an asset on WhiteBIT?

There are three ways: cryptocurrency exchange, Auto-Invest, and trading by placing an order. Let’s examine each one.

Convert

The “Convert” tool is suitable for beginners and those who want to instantly convert one asset into another at the current market rate. With just a few clicks, you can convert all cryptocurrencies or fiat currencies listed on the exchange. This feature is also available for assets not listed in pairs on our exchange. During the exchange, the rate is fixed for 10 seconds, after which it can be updated.

Buy crypto faster than anyone else

To exchange assets:

- Register on the WhiteBIT exchange and verify your identity (KYC) or log in to your account if you already have a verified account.

- Open the “Trade” section and proceed to the “Convert” page.

- Select the asset you want to give and the asset you want to receive.

- Specify the amount of the asset to be exchanged. You can exchange all available assets. To do this, click the “Max” button. The system will display the amount you will receive in USDT equivalent.

- Click the “Continue” button, double-check all the details, and click “Accept” to complete the exchange.

- If you don’t have enough assets in your balance to make the exchange, use the ‘Deposit’ button.

- After the exchange, you can go to your balance by clicking the “Go to balance” button.

- To view your transaction history, go to the “History — Exchange” section.

Auto-Invest

Auto-Invest is another tool for automatically buying cryptocurrency. Simply set up a plan for the selected cryptocurrency, specify the amount and frequency of purchases. The tool will automatically buy the asset for you.

You can set up an Auto-Invest plan on WhiteBIT in a few minutes:

- Go to the “Products” tab in the main menu of the exchange and select Auto-Invest;

- Next, select the cryptocurrency you want to buy;

- Specify the amount of cryptocurrency you want to buy;

- Specify the purchase frequency — with Auto-Invest plans, you can buy the desired assets on an hourly or monthly basis, depending on your preferences.

And advanced settings allow you to set the minimum and maximum price range and the number of purchases until your plan is completed.

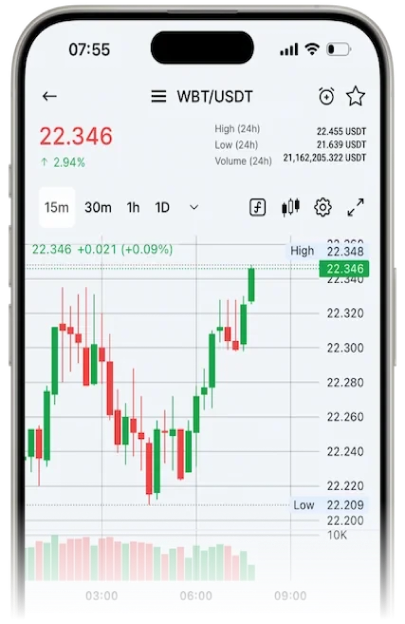

Trading

There are several types of markets on our exchange: Spot, Margin, and Futures.

In this guide, we will only cover Spot. This is because it has all the necessary tools for beginners with no trading experience.

Buy crypto on your terms

To buy or sell an asset on the spot market, do the following:

- Transfer your funds from your main balance to your trading balance. To do this, go to the Main Balance section and click “Transfer” next to the desired currency.

- Enter the desired amount and click “Confirm.”

- Now click on the ‘Trade’ section and select Spot.

- In the “Market” window, select a pair (for example, BTC/USDT).

Now you can start creating and placing an order. An order is a request to buy or sell an asset, a kind of instruction that a user gives to the exchange to buy or sell an asset. An order can be canceled (provided that it has not been accepted or executed). In the next section, we will look at the main types of orders.

Types of orders

The two main types of orders that you see first in the list are Limit orders and Market orders. All others are derived from them.

- Limit order — a “passive” type of order in which the trader specifies the desired price for the transaction. The limit will only be executed at the specified price or better.

- Market order — an “active” type of order that is instantly matched with the best available Limit order and executed at the best market price. It guarantees that the order will be executed, but does not guarantee the execution price.

- Stop-Limit order — helps you buy an asset at a price not lower than a certain level (Stop). Once the asset reaches it, the order is activated and, at the price specified in “Stop,” it enters the order book and works like a regular limit order.

- Stop-Market — also helps you buy an asset at a price not lower than a certain level (Stop). As soon as the asset reaches the price specified in the “Stop” field, the order is activated and immediately executed at the best available price on the market as a regular Market order.

- Multi-Limit order — is a mode that allows you to create a whole grid of Limit orders to buy or sell an asset at different prices and in different quantities. This article provides more details about Multi-Limit orders.

Now you understand the basic types and functions of orders.

All active trades are displayed in the “Activity” section — “My Orders.”

Inactive and completed orders can be viewed in the History section, located in the “Orders” tab at the top right of the screen.

That’s it! We hope this article was helpful and helped you understand how to buy cryptocurrency on WhiteBIT.

We wish you successful trades!