What Is Cryptocurrency And How Does It Work?

Each year, cryptocurrency is becoming increasingly ingrained in daily life. By 2025, it will be hard to find anyone who hasn’t at least heard of it. However, popularity doesn’t always equate to understanding. This article will provide a comprehensive guide to cryptocurrency, explaining how cryptocurrency works from a technological perspective, exploring the history of cryptocurrency, and outlining the opportunities and risks it presents to both users and investors.

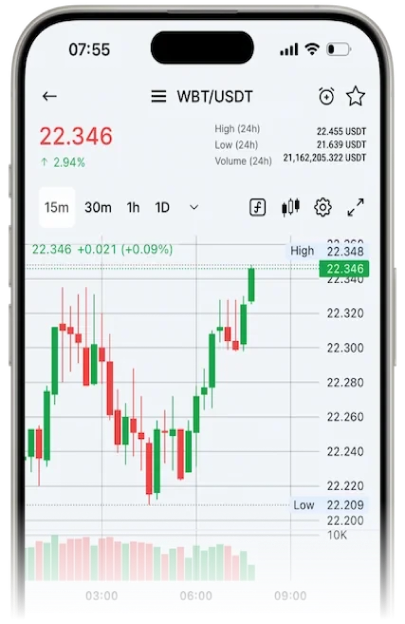

Real-time Crypto Rates

What Is Crypto?

Cryptocurrency is a digital asset used for exchanging and storing value online. It operates independently of traditional financial institutions or governments and relies on blockchain technology — a decentralized database that records crypto transactions, ensuring their security and immutability. Each block in the chain is connected to the previous one, making it impossible to alter the data without the network’s consent. Understanding cryptocurrency enables peer-to-peer transactions, eliminating intermediaries, which speeds up the process and reduces transfer costs.

There is ongoing debate about the exact origins of cryptocurrency and its inventor. The idea of cryptocurrency was first realized in 2008 when an anonymous developer or group under the pseudonym Satoshi Nakamoto introduced the concept of Bitcoin in a document called the “Whitepaper.” In 2009, the Bitcoin blockchain was launched, and its first transaction occurred between Satoshi Nakamoto and programmer Hal Finney. This is considered the start of the cryptocurrency era.

What Is Crypto?

Cryptocurrency is a digital asset used for exchanging and storing value online. It operates independently of traditional financial institutions or governments and relies on blockchain technology — a decentralized database that records crypto transactions, ensuring their security and immutability. Each block in the chain is connected to the previous one, making it impossible to alter the data without the network’s consent. Understanding cryptocurrency enables peer-to-peer transactions, eliminating intermediaries, which speeds up the process and reduces transfer costs.

There is ongoing debate about the exact origins of cryptocurrency and its inventor. The idea of cryptocurrency was first realized in 2008 when an anonymous developer or group under the pseudonym Satoshi Nakamoto introduced the concept of Bitcoin in a document called the “Whitepaper.” In 2009, the Bitcoin blockchain was launched, and its first transaction occurred between Satoshi Nakamoto and programmer Hal Finney. This is considered the start of the cryptocurrency era.

How Does Cryptocurrency Work?

Cryptocurrency operates through blockchain, which records all transactions in a chain of blocks. Each block contains data about the transferred assets, along with a unique code (hash) that links it to the previous block. This system ensures that once data is recorded, it cannot be altered, providing immutability and transparency across the entire cryptocurrency network.

Cryptocurrency transactions occur over a peer-to-peer network, where each participant (node) serves as both a sender and receiver of information. When a user sends cryptocurrency, their transaction is verified and added to the blockchain through mining (for Proof of Work) or staking (for Proof of Stake). Once verified, the transaction becomes part of a public record that is accessible to all network users. This process prevents double-spending and allows for direct transactions without third-party involvement.

Cryptocurrency vs Traditional Money

Fiat currencies, such as dollars or euros, are regulated by governments and financial institutions. They can exist in both physical and digital forms and rely on central banks for their issuance and control. However, fiat currencies can be printed in unlimited amounts, leading to inflation, and they are vulnerable to counterfeiting. Additionally, traditional money is difficult to use anonymously, challenging to move and store, and banks have the authority to freeze accounts or restrict access.

In contrast, cryptocurrencies offer a decentralized, anonymous, and secure system that operates independently of central authorities. Blockchain technology allows each transaction to be verified for authenticity, ensuring transparency and preventing data manipulation. Cryptocurrencies enable anonymous transfers without intermediaries, giving users full control over their funds. It’s also worth noting that the supply of cryptocurrencies can be limited, making them scarce and potentially more resistant to inflation.

Advantages and Disadvantages of Cryptocurrency

Let’s look at the main disadvantages and advantages of cryptocurrency:

| Pros | Cons |

| Decentralization | High volatility |

| Some cryptocurrencies offer complete anonymity | Lack of regulation |

| Low fees | Limited liquidity |

| Simplifies the transfer of funds between parties | Complexities with tax accounting |

| Transparency and security | No protection against losses |

| Fast transaction processing | Requires skills to interact |

Let’s highlight some of the most important advantages:

Here are some key advantages of cryptocurrencies:

- Decentralization: Cryptocurrencies are not controlled by governments or financial institutions, making them independent of political and economic factors. This reduces the risks associated with inflation, currency devaluation, or financial crises and eliminates the need for intermediaries.

- Anonymity: Cryptocurrencies offer a high level of confidentiality, enabling users to make transactions anonymously. This is crucial for those who value their privacy or wish to keep their financial activities private from governments and third parties.

- Global Accessibility: Cryptocurrencies enable people around the world to exchange value without being bound by borders or national currencies. This is particularly beneficial for individuals in countries with unstable financial systems or those seeking to minimize the cost of international transfers.

However, there are also some disadvantages of cryptocurrency:

- High Volatility: Cryptocurrencies are known for their price volatility. The value of a cryptocurrency can fluctuate dramatically within a short period, making them unpredictable for investors.

- Limited Liquidity: Some cryptocurrencies may suffer from limited liquidity, making it difficult to exchange them for fiat money or other assets, especially on less-known exchanges. This can complicate asset sales when needed.

- Lack of Regulation: The absence of clear legal frameworks and regulations in various countries creates uncertainty for cryptocurrency users. This lack of regulation can also lead to legal risks, particularly if cryptocurrencies are used for illicit or controversial transactions.

Key Cryptocurrency Types

All cryptocurrencies other than Bitcoin are commonly referred to as altcoins. Bitcoin (BTC) was the first cryptocurrency and remains the most valuable and widely used one to this day. Altcoins serve various purposes, such as enhancing scalability (e.g., Ethereum), enabling smart contracts, and facilitating faster or more affordable transactions. This category includes thousands of different types of cryptocurrencies, including stablecoins (e.g., Tether, USD Coin), which are pegged to the US dollar at a 1:1 ratio, NFTs (Non-Fungible Tokens) used to certify ownership of unique crypto assets, governance tokens that allow participation in decision-making within projects, security tokens that represent rights to real-world assets, and cryptocurrencies optimized for fast, cheap, and anonymous transactions.

Is Cryptocurrency Safe?

Blockchain provides a high level of data protection because it uses cryptography to secure transactions, making them virtually impossible to forge or alter. However, the security of cryptocurrencies also depends on how you store and use them. For example, if you store your funds on a cryptocurrency exchange, they may be at risk of hacking or other platform vulnerabilities. Therefore, it is important to know how to choose an exchange and diversify your assets. Using reliable wallets, such as hardware wallets, significantly increases the level of security, since the private key is stored offline, making it less vulnerable to hacking and phishing.

It is also worth considering that cryptocurrencies are subject to risks associated with the lack of regulation in different countries, which can make it difficult to protect your assets in the event of fraud or theft. However, with the right approach to storage and transactions, cryptocurrencies can be quite safe for users within the cryptocurrency industry.

How Does Cryptocurrency Have Its Value?

The value of cryptocurrency is determined by market supply and demand, much like traditional assets. Key factors that influence the price include liquidity, trading volume, news related to the cryptocurrency, technological updates, and its adoption across various countries and industries. Large investors, often referred to as “whales,” also have a significant impact, as their large transactions can substantially affect the price.

What Is Cryptocurrency Used For?

Here are 10 key ways to use cryptocurrency:

- Means of Exchange — Used to pay for goods and services from vendors who accept cryptocurrency.

- Investment — Cryptocurrencies are often used as long-term assets for storing value.

- Transfers — Cryptocurrencies enable quick and inexpensive fund transfers without intermediaries, regardless of location.

- Trading — Actively used for speculative trading on cryptocurrency exchanges.

- Micropayments — Ideal for small transactions with low fees, such as tips or donations.

- Smart Contracts — Cryptocurrencies like Ethereum are used to create automated agreements between parties.

- Decentralized Finance (DeFi) — Provides access to financial services like lending and borrowing without traditional banks.

- Crowdfunding — Raised funds for projects via cryptocurrency platforms.

- NFTs (Non-Fungible Tokens) — Used to buy and sell unique digital assets such as art, music, and collectibles.

- Privacy — Ensures anonymous payments and protects users’ personal data.

Top 10 Cryptocurrencies by Market Cap

The market capitalization of a cryptocurrency is the total value of all its coins in circulation. It is calculated by multiplying the current price of the coin by the number of crypto coins in circulation. This metric is useful for assessing the relative size and stability of a cryptocurrency within the market.

As of September 30, 2025, the most popular cryptocurrency examples by market capitalization, according to CoinMarketCap, are:

- Bitcoin (BTC) — $2,254,143,048,132

- Ethereum (ETH) — $501,638,802,409

- Tether (USDT) — $174,751,255,564

- Ripple (XRP) — $170,764,985,896

- Solana (SOL) — $112,446,748,708

- USD Coin (USDC) — $73,401,257,736

- Dogecoin (DOGE) — $34,665,071,035

- TRON (TRX) — $31,740,599,435

- Cardano (ADA) — $28,280,621,191

- Hyperliquid (HYPE) — $15,082,180,878

Crypto Risks and Scams to Watch Out For

Cryptocurrencies attract not only investors but also scammers. Key risks include phishing, where attackers attempt to steal users’ personal data by pretending to be official services; pyramid schemes that promise high returns by recruiting new participants; scam projects, including fake ICOs (initial coin offerings), where projects may turn out to be fraudulent; and insecure wallets and exchanges, where hackers can steal funds. It’s essential not only to know how to work with cryptocurrency, but also to verify sources and use trusted platforms and services with a solid reputation. Doing so will help protect your funds and avoid the increasing risk of fraud in the crypto industry.

Is Cryptocurrency a Good Investment?

Cryptocurrency can be an appealing investment for those willing to take on high risks. It offers the potential for substantial profits but also carries risks of cryptocurrency such as high price volatility and the absence of clear regulation. While cryptocurrencies can be a valuable addition to a diversified portfolio, it’s crucial to understand the market and be prepared for unexpected changes in its dynamics.

Basic Steps to Buying Cryptocurrency for Beginners

Buying cryptocurrency may seem complicated for beginners, but in reality, the process is simple and straightforward if you follow a few easy steps. If you’re getting started with cryptocurrency, understanding these basic steps will make the process much easier and more manageable:

- Choose a Cryptocurrency Exchange — Register on a verified platform, such as WhiteBIT.

- Complete the KYC Procedure — Verify your identity with required documents.

- Fund Your Account — Deposit money via bank transfer, card, or other available methods.

- Select a Cryptocurrency — Choose the coin you want to buy.

You can buy cryptocurrency on WhiteBIT in three ways: through converter, auto-invest, or placing an order.

What Is the Future Of Crypto?

The future of cryptocurrency looks promising, with ongoing advancements in technologies like blockchain and smart contracts that are broadening the scope of cryptocurrencies across various sectors, including finance, healthcare, and logistics. As interest in DeFi, NFTs, and digital assets continues to grow, cryptocurrencies are becoming an integral part of the global economy, offering users greater freedom and control over their funds. However, the future of cryptocurrencies will also be shaped by regulation, as governments worldwide begin to implement laws that could impact their accessibility and usage.

Trade cryptocurrency on WhiteBIT Georgia

The Bottom Line

Whether you view cryptocurrencies as a way to invest or as a means for fast payments, it is important to understand how they work and to be aware of potential benefits of crypto and risks. The crypto technology behind cryptocurrencies promises significant transformations in the global financial system, and we are fortunate to be part of this process.

FAQ

The legality of cryptocurrency depends on the country. In some countries, it is completely legal, while in others it is restricted or prohibited.

Cryptocurrency has enormous potential to change financial systems, but its future depends on regulation and acceptance on a global level.

You can use cryptocurrency to pay for goods and services, invest, make international transfers, and use it in decentralized applications.

You can store cryptocurrency in wallets (hardware, software, or online), ensuring its security with private keys.

Fake cryptocurrencies often have low liquidity, are not listed on major exchanges, and lack transparent information about the project. It is important to check the reputation and sources.