GoodCrypto trading bots in a nutshell: Grid bot

Recently, we’ve discussed and explained the peculiarities of the GoodCrypto app and the variety of trading bots it offers. A brief recap: GoodCrypto is an advanced all-in-one trading and portfolio management app that allows trading on 35+ most popular spot and derivatives crypto exchanges with a wide range of the most wanted features and tools, including advanced trading bot strategies.

Trading bots are one of the most useful solutions for trading optimization. They can simplify your trading routine, save your time, and increase the value of your portfolio with almost no effort from your side.

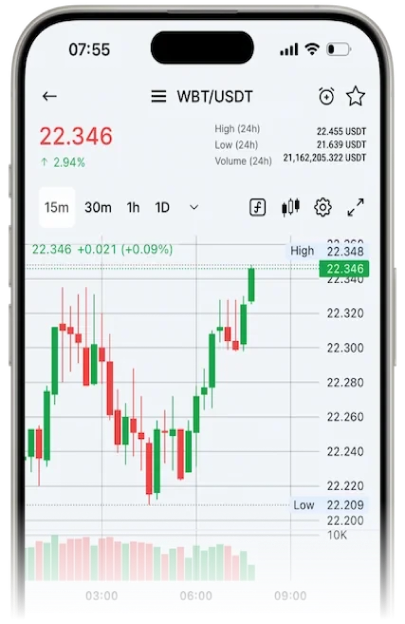

Firstly, let’s cover grid bots that take advantage of times when the market is flat and lacks significant trend movements. The bot sets up a grid of buy and sell orders evenly spaced, allowing it to capitalize on any market fluctuations within a specified range as the price moves across the grid. This clever approach allows profiting from in-range market volatility even when there are no substantial trends in play.

What are grid bots useful for?

The ability to identify optimal entry and exit points is what identifies truly successful traders. During the phases of market stagnation, the risk of incurring losses is exceptionally high. There’s no reliable and straightforward structure to rely on, and the market can abruptly shift against us at any moment. Nevertheless, the emergence of automated trading bots has revolutionized the landscape. These tools significantly enhance the potential for consistent trading success for all participants in the market. With the Grid bot, any trader can seize maximum profit from even the slightest market movements due to the grid trading strategy.

The Grid bot automatically maintains and manages a grid of buy and sell limit orders within a specific price range and buys or sells fixed amounts of crypto. These orders are evenly spaced and equally sized. When a buy order is executed, the bot places a sell order a level above if the price moves up. Similarly, when a sell order is completed, the bot places a buy order a level below if the price moves down. The Grid bot operates continuously until the target profit level is attained or until the trader manually stops it.

GoodCrypto provides two options of Grid bots that can be used during different market cycles: Long, suitable for bullish markets, and Short, which is the best for bearish markets.

Come up with a grid trading strategy

By adhering to a couple of recommendations and implementing the Grid bot strategy, traders can optimize their capital utilization, effectively increasing their chances of profiting.

- Determine market movement priority: Before launching a Grid bot, it is crucial to set the expected direction of market movement within your desired timeframe, whether it is a downward trend, a flat, or an uptrend.

- Select the appropriate bot for the market condition: Opt for a Long Grid bot with an initial grid of buy orders when anticipating an uptrend. Conversely, use a Short Grid bot with a grid of sell orders at the start of a downtrend. In a flat market, a Neutral Grid is ideal for operating within a range, facilitating the purchase of assets at lower prices and selling them at higher prices. This strategy ensures consistent profits even in low-volatility market conditions.

- Customize order size and the number of levels: Manually set the order size (buy/sell) and the number of levels based on your risk tolerance, deposit size, and trading objectives. This allows for a tailored approach that aligns with your specific strategy.

- Leverage the power of the Grid’s principle: Launch your Grid bot to capitalize on market movements within a predefined range using Grid’s principle.

It looks like it’s time to try out the trading tools for optimized and effective trading, doesn’t it?

Launch your first Grid bot and experience the convenience and profitability of this strategy. Explore other crypto bot strategies, including DCA and unique Infinity Trailing, tailored for trading on WhiteBIT, and enjoy seamless profitable trading with uninterrupted market engagement around the clock!