Infinity Trailing Bot by GoodCrypto Explained

Say goodbye to the stress of navigating the volatile market. Experience effortless cryptocurrency trading with the Infinity Trailing bot by GoodCrypto. This advanced bot detects and capitalizes on significant price fluctuations, enabling you to maximize profits when the market aligns with your strategy.

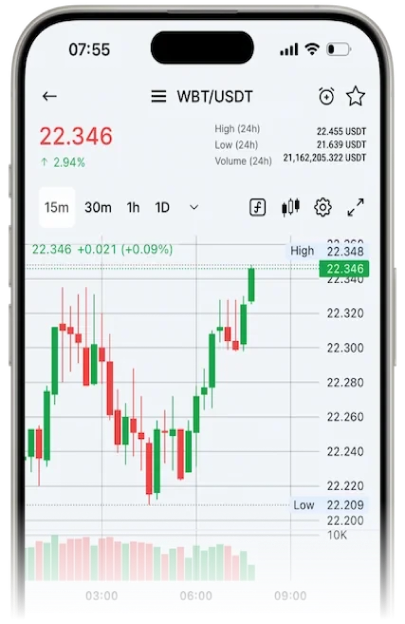

In a nutshell, a Trailing stop is an order type created to lock in profits or limit losses as a trade moves positively. It is a stop-loss order, which moves together with the asset price if it moves favourably. Once it moves to lock in a profit or decrease a loss, its execution price does not move back.

Infinity Trailing Bot Basics

The Infinity Trailing bot is a unique crypto trading bot by GoodCrypto that simplifies trading by automating Trailing stop buy and sell orders. To set it up, you must specify your desired trailing distance for position exit and entry based on observed market volatility. Once configured and launched, the algorithm takes control, continuously placing Trailing buy and sell orders until your profit target is achieved or you manually stop it.

GoodCrypto provides two variations of the Infinity Trailing bot. The first type immediately places a Trailing stop order to exit the position after it’s opened. The second won’t close the position with a loss, ensuring the exit order is executed at a profit. Although their setup differs only by enabling or disabling the “only exit at a profit” option, it transforms them into two distinct algorithms. A third type, currently under development, incorporates technical signals for entry and exit, promising to be a powerful tool upon its release.

Let’s take a closer look at both of them!

Infinity Trailing With “Only Exit at Profit” OFF

The Infinity Trailing bot, with “only exit at a profit” mode off, is designed to profit from large swings in the cryptocurrency market. It is recommended to use in high-volatility pairs or during high-volatility, as it excels in capturing significant price movements.

While the bot may incur small losses during periods of minor in-range volatility, it compensates for them when there are substantial swings. For example, with a 1% trailing distance, it might experience small losses multiple times in a row but make up for them and surpass them when the market moves 5–10%. Therefore, patience is essential when using this setup.

The bot uses Trailing stop orders to enter and exit the positions. By understanding how these orders work, you can grasp the behavior of the Infinity Trailing bot. The bot follows (trails) the market price in your favor, disregarding movements smaller than the chosen trailing distance. It incurs losses on price moves greater than the trailing distance less than 2x the trailing distance, but the position becomes profitable on moves larger than 2x the trailing distance.

Infinity Trailing With “Only Exit at Profit” ON

The “only exit at a profit” mode ensures that positions are not closed at a loss, giving you more control over your investments. Hence, the bot waits for the price to reach your desired profit level before triggering the exit order.

In the best-case scenario, as the price of the coins experiences significant fluctuations, you can profit from the volatility while capturing the majority of the price moves. Even if the price suddenly surges, the bot will enter a new position after exiting the previous one, ensuring you don’t miss out on the opportunity.

In the worst-case scenario of the price declining after buying with the Infinity Trailing bot, you still have purchased BTC with a Trailing stop order, which is a suitable method of buying. The bot will stay in the position until the price recovers, so the position is profitable again.

Overall, the “only exit at a profit” mode of the Infinity Trailing bot is a valuable tool for holders who want to take advantage of market volatility without the risk of missing sudden upward price movements.

Conclusion

The Infinity Trailing bot by GoodCrypto is a powerful tool that helps to maximize profit in a volatile crypto market. By choosing the correct mode and setting up a crypto bot with the proper trailing distance, traders can catch and profit from large swings up or down.

Good luck, and have a profitable trade!